NO MORTGAGE SOLICITATION ACTIVITY OR LOAN APPLICATIONS FOR PROPERTIES LOCATED IN THE STATE OF NEW YORK CAN BE FACILITATED THROUGH THIS SITE.

#Intuit mint ira free

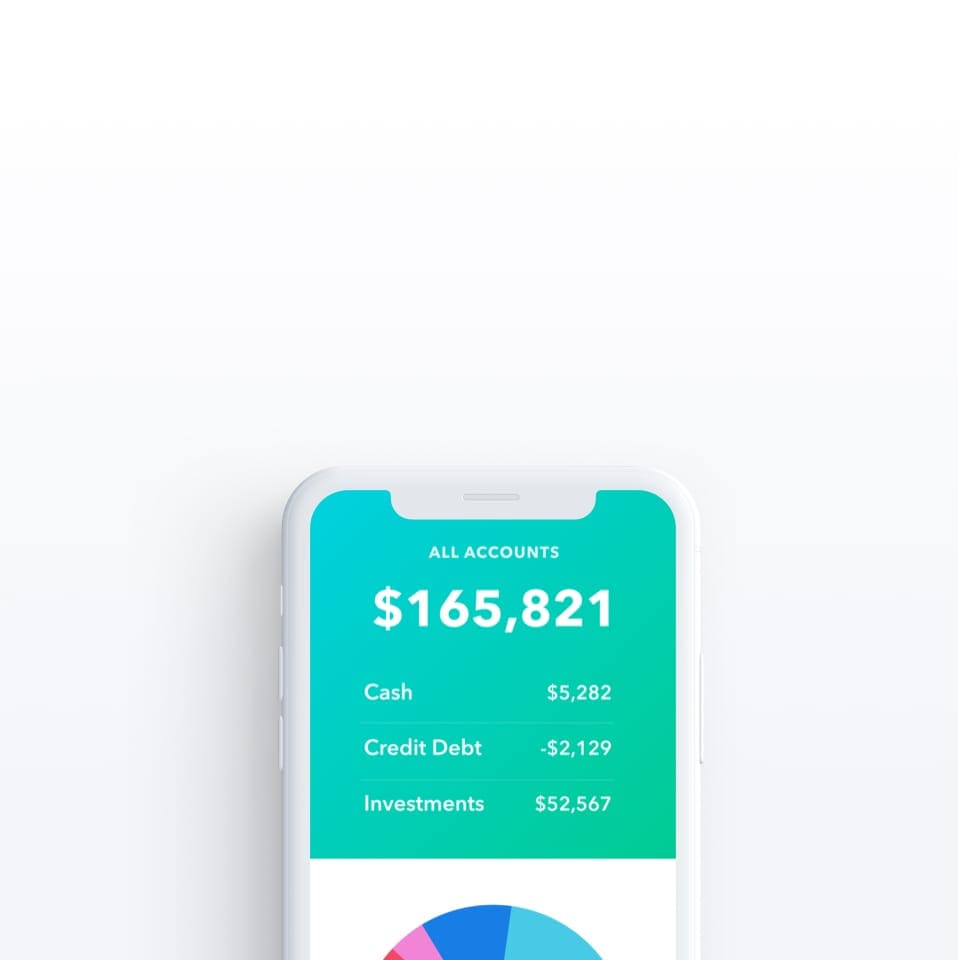

Our free budget tracker helps you understand your spending for a brighter financial future. Sign in links to Intuit products like TurboTax, QuickBooks, Mint, and more. THIS SITE IS NOT AUTHORIZED BY THE NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES. Take charge of your finances with Mints online budget planner. 2 reviews of Mint Motorworks Corp I always dread buying a new car. Intuit Mint is most often used by companies with >10000 employees & >1000M in revenue. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR RESIDENTIAL MORTGAGE

#Intuit mint ira generator

CFL License #60DBO-116115 | License and disclosure | NMLS Consumer Access LEAD GENERATOR ONLY, NOT ACTING IN THE CAPACITY OF A MORTGAGE LOAN ORIGINATOR, MORTGAGE BROKER, MORTGAGE CORRESPONDENT LENDER OR MORTGAGE LENDER. We compared features, ease of use, costs, and much more of popular budgeting apps Mint and YNAB to help you decide which tool is the best choice for you. In California loans are made or arranged by Intuit Mortgage Inc. (CFL #6055856) | Licenses The Mint Mortgage experience is a service offered by Intuit Mortgage Inc., a subsidiary of Intuit Inc, NMLS #1979518. In California, loans are made or arranged by Intuit Financing Inc. Get students up to speed with budgeting, credit scores, savings, and more using Mint. ( NMLS #1136148), a subsidiary of Intuit Inc. Teach personal finance basics with Mint Help students take control of their finances and their futures.

#Intuit mint ira pro

Look at the Form 8606 instructions to see that Trad IRA, SEP, and SIMPLE IRA are lumped together for purposes of a conversion Pro Rata computation.Intuit Personal Loan Platform is a service offered by Intuit Financing Inc. It's not considered distribution but it is partially taxable. "and the conversion of the new traditional IRA that they opened this year will be considered distributions as part of the pro-rata rule/ “cream in your coffee” rule."

"Their concern is that the Simple IRA will be considered to be a traditional IRA or 401K by the IRS" A SIMPLE IRA would be a No Basis, Never Taxed, amount. There will be prorated taxes, based on that Nondeductible amount against all never taxed amounts. Personally, I don't care about anything but the bottom line: What do I need to open with Mint/where on the site, how much do I have to invest immediately or by the cut off (April), and how long must I wait to a) be approved and b) acquire that 5500 deductible to weigh against. Will they be responsible to pay taxes on the conversion of the traditional IRA to the Roth IRA?"Ī person can't do Backdoor that is tax free if there is pre-tax and never-taxed money in a similar type of account, such as what you see on Form 8606. I'd already been considering opening an IRA, but it's all Latin to me and there's an overwhelming number of options. "They contributed 12k for each of them into the backdoor Roth IRA (6k for 2021 and 6k for 2022). There is no Joint event for retirement activities. (which also produces TurboTax, QuickBooks, and Credit Karma ). The Simple IRA has a cost basis of $5,730 and market value of $13,844." Mint, also known as Intuit Mint (styled in its logo as intuit mint with dotted 't' characters in 'intuit' and undotted 'i' characters) and formerly known as, is a personal financial management website and mobile app for the US and Canada produced by Intuit, Inc. "and contributed post tax dollars to it and then converted it to a Roth IRA. Pre-taxed contributions and employer matches are not Basis. We make it easy for small businesses to offer tax-advantaged retirement plans. It is different than Traditional IRA (which is not done through an employer) and different than 401(k) plans. Savings Investment Match Plans for Employees (SIMPLE IRAs) from Fidelity. 48 is put back into the local economy, according to data from Intuit Mint. The word "SIMPLE" means "Savings Incentive Match Plan for Employees" and does not mean "basic" or "plain." It does not mean generic, either. Prior to 2020, a beneficiary who inherited a traditional IRA could stretch. The simulations use a fictional character, bank account, email, and more, for a safe, fun learning environment. Do not use any personal information in the simulation. All simulations and W2s are meant to be fictional. Plus, the Mint IRA advisor makes it easy to choose and open an IRA so you can deduct up to. Watch the video for easy steps to get started. "The Simple IRA has a cost basis of $5,730" Mints safety and security features include multi-layered protections for your financial data, making Mint a safe and trusted choice to track your money. Mint and TurboTax have teamed up to make tax time easier.

0 kommentar(er)

0 kommentar(er)